Do I need insurance for my solar panels?

Claudia Pardo, Content Specialist at Sunhero and a firm believer that solar energy can transform the world.

18/10/2024

3 min read

Table of Contents

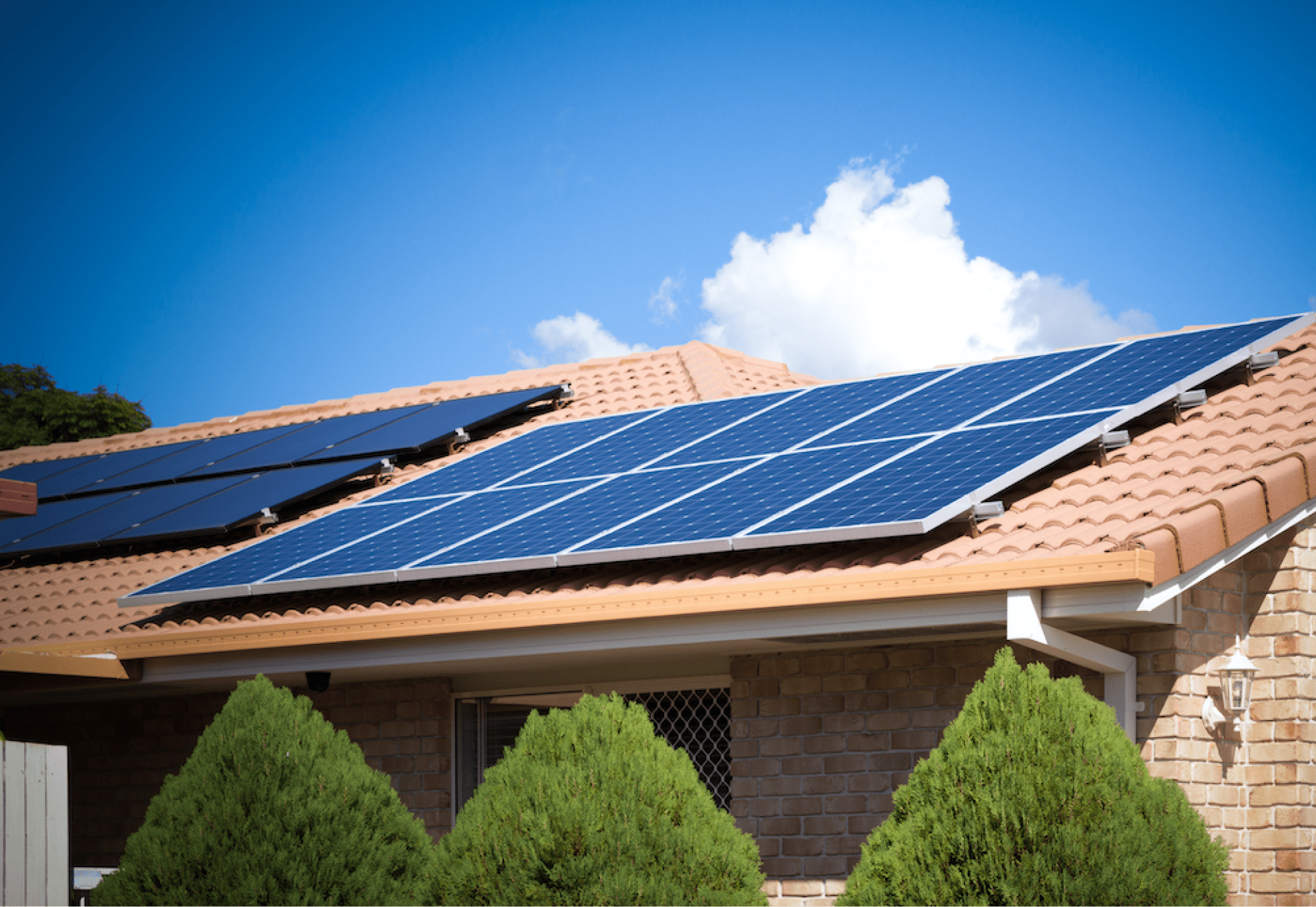

If you are thinking about installing solar panels at home, you are probably wondering if you need a specific insurance for them or if your home insurance will be sufficient. This is a key point to consider, and we want to help you resolve this question clearly in this blog article.

Coverage with home insurance

In many cases, solar panels installed on a home are covered by home insurance, as they become part of the property. This means that, in the event of risks such as fire, storms, or vandalism, your home insurance policy could protect your solar panels as part of structural damage.

However, it is essential to review the terms and conditions of your current policy, as some insurers may require you to inform them about the installation to extend coverage or adjust the insured value.

Coverage based on the location of the solar panels

The coverage of solar panels under home insurance may vary depending on the installation and the specific policy.

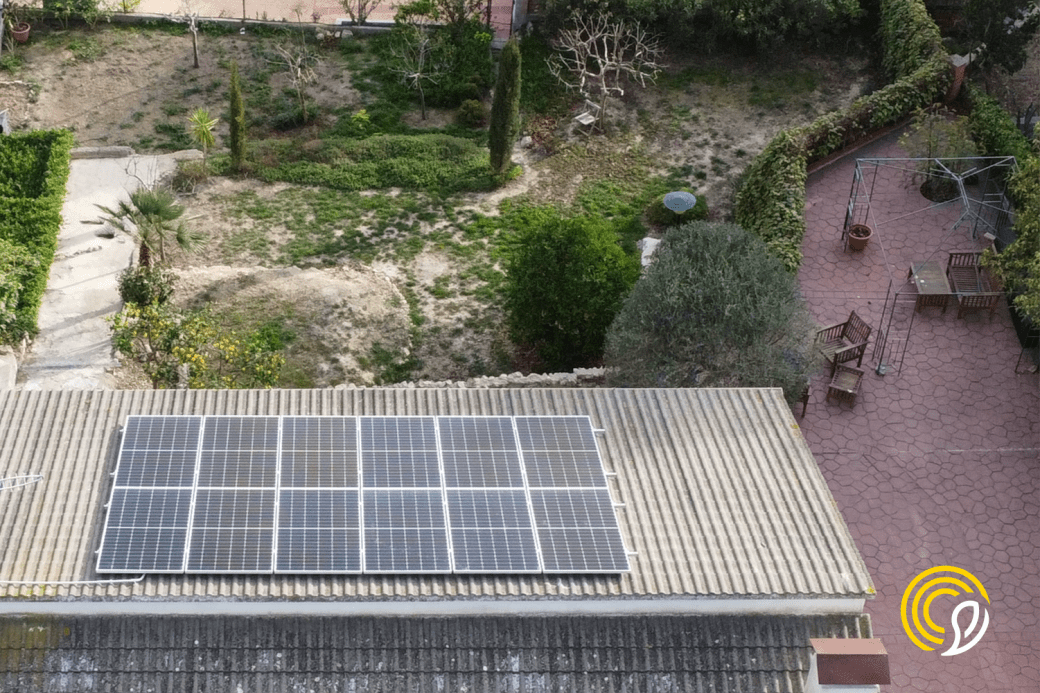

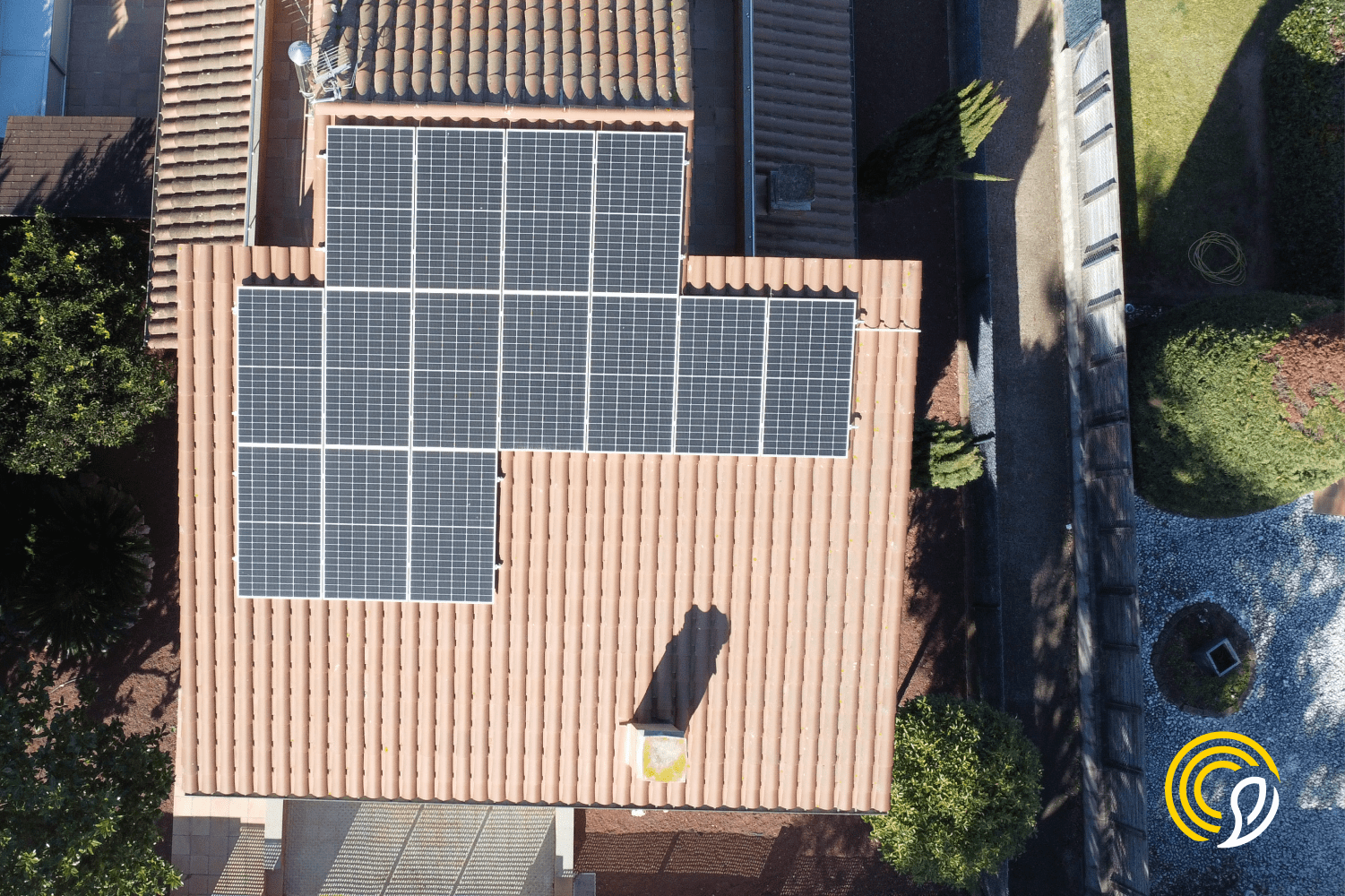

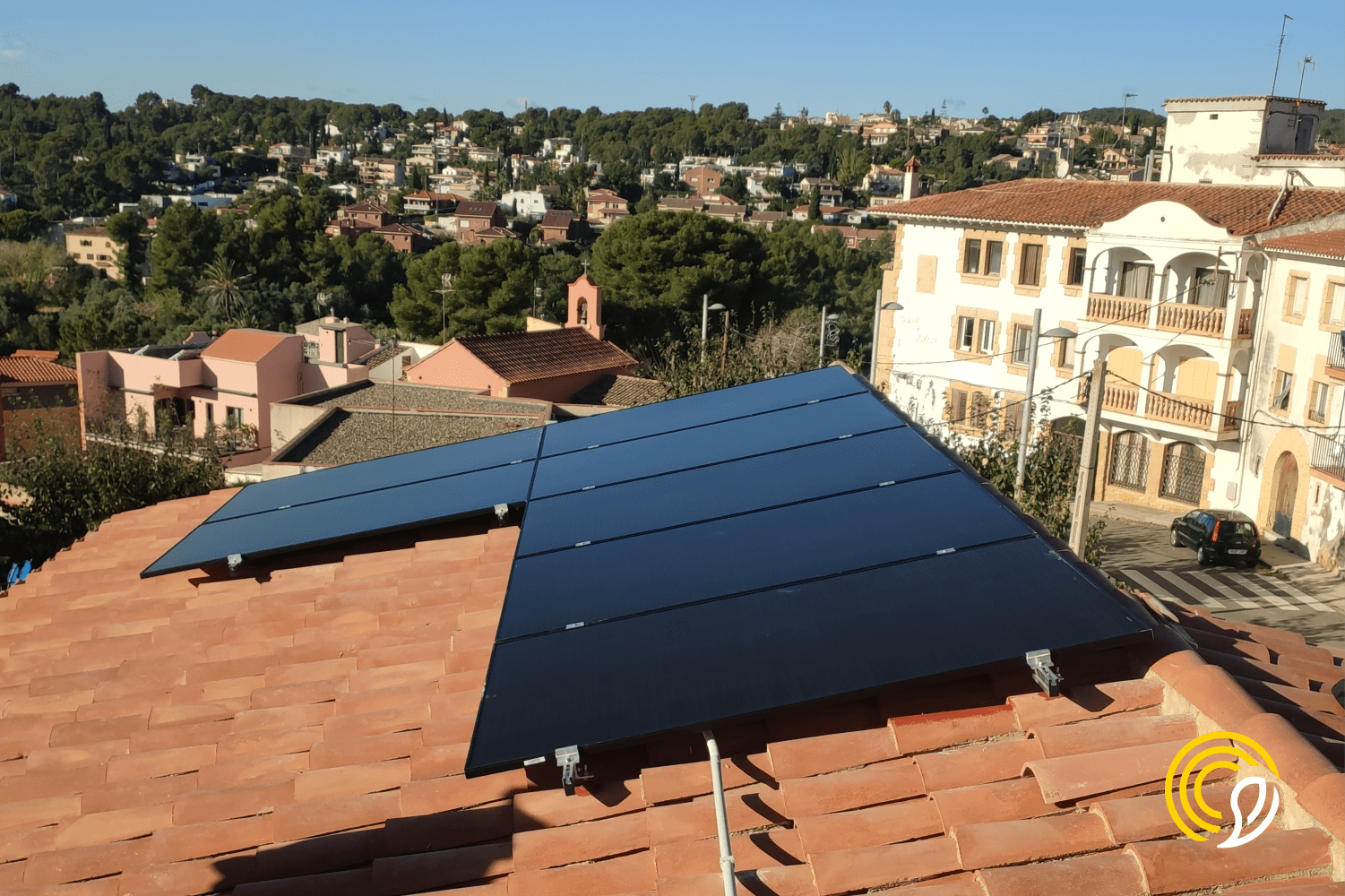

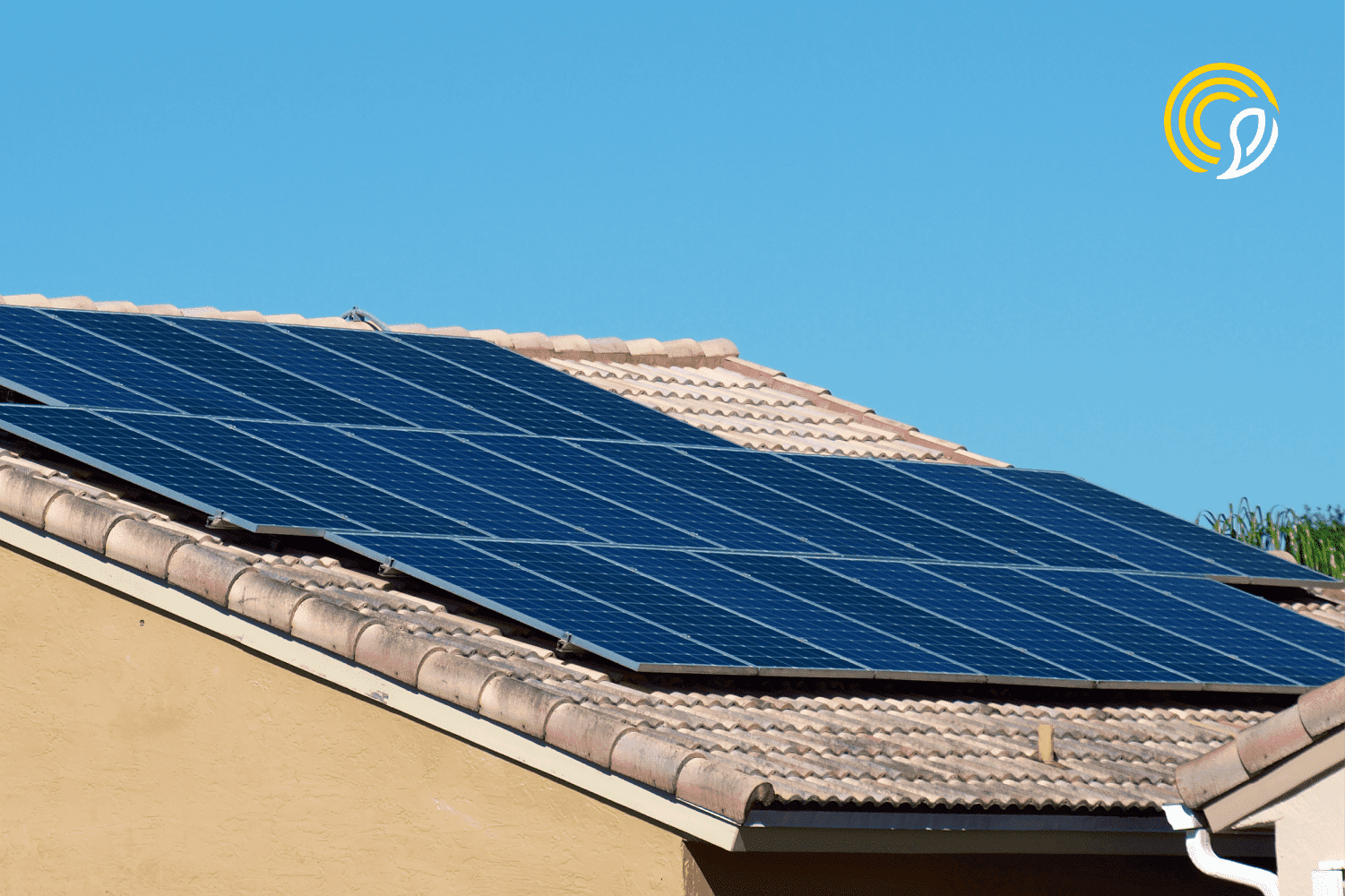

Generally, if the panels are installed on the roof of the house, they are considered part of the structure and, therefore, covered by “dwelling damage” coverage. This means that, in case of risks like fires, storms, or vandalism, your insurance could cover repair or replacement costs.

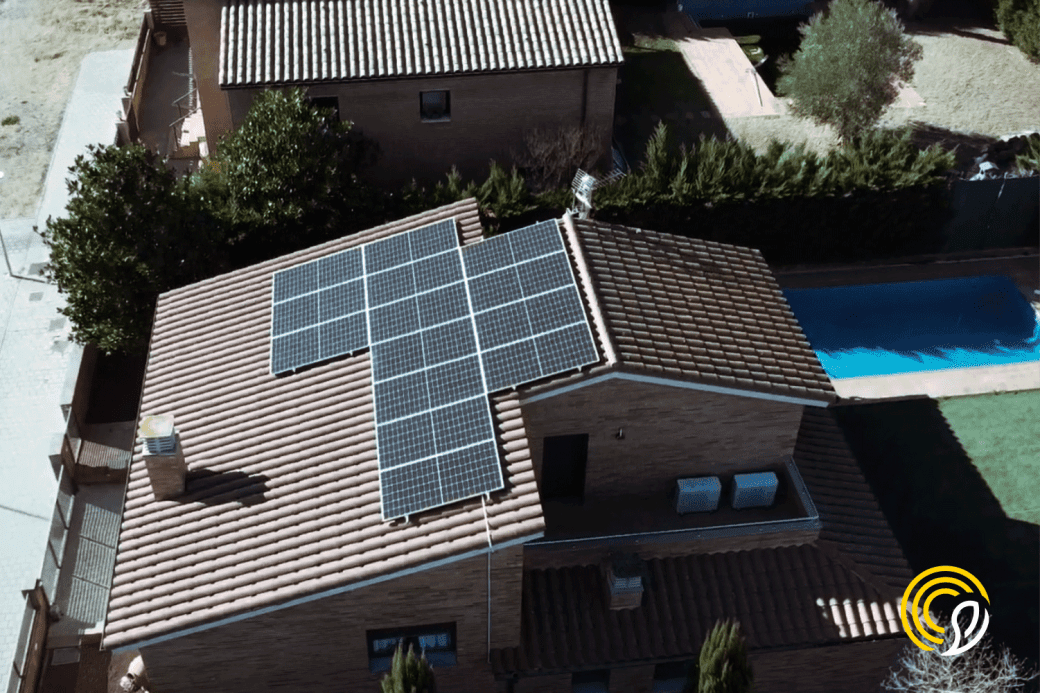

However, if the panels are on an independent structure, such as a detached garage or ground-mounted, they might be covered under “other structures coverage,” but this coverage typically has lower limits than the main dwelling.

Necessary adjustments to the insurance policy

If you install solar panels at home, it is recommended to inform your insurer about the installation, as you might need to adjust your policy limits to reflect the additional value of the panels.

Some insurers may require a supplement or extended coverage, especially if the panels are installed in unconventional locations or if the policy excludes certain risks, such as hail or wind damage. Therefore, it is advisable to review your policy terms and consult with your insurer to ensure your solar panels are adequately protected.

When is a specific insurance for solar panels recommended?

In certain situations, it may be advisable to take out specific insurance for solar panels. This is especially important if:

- Your current policy does not cover specific damages to the panels, such as hail damage or falling objects.

- You have an installation on a second home or land that is not covered by home insurance.

- You want additional protection for potential technical failures or loss of energy performance due to malfunctions.

Specialized insurance can provide more comprehensive protection against unforeseen events that directly affect the operation of your photovoltaic system.

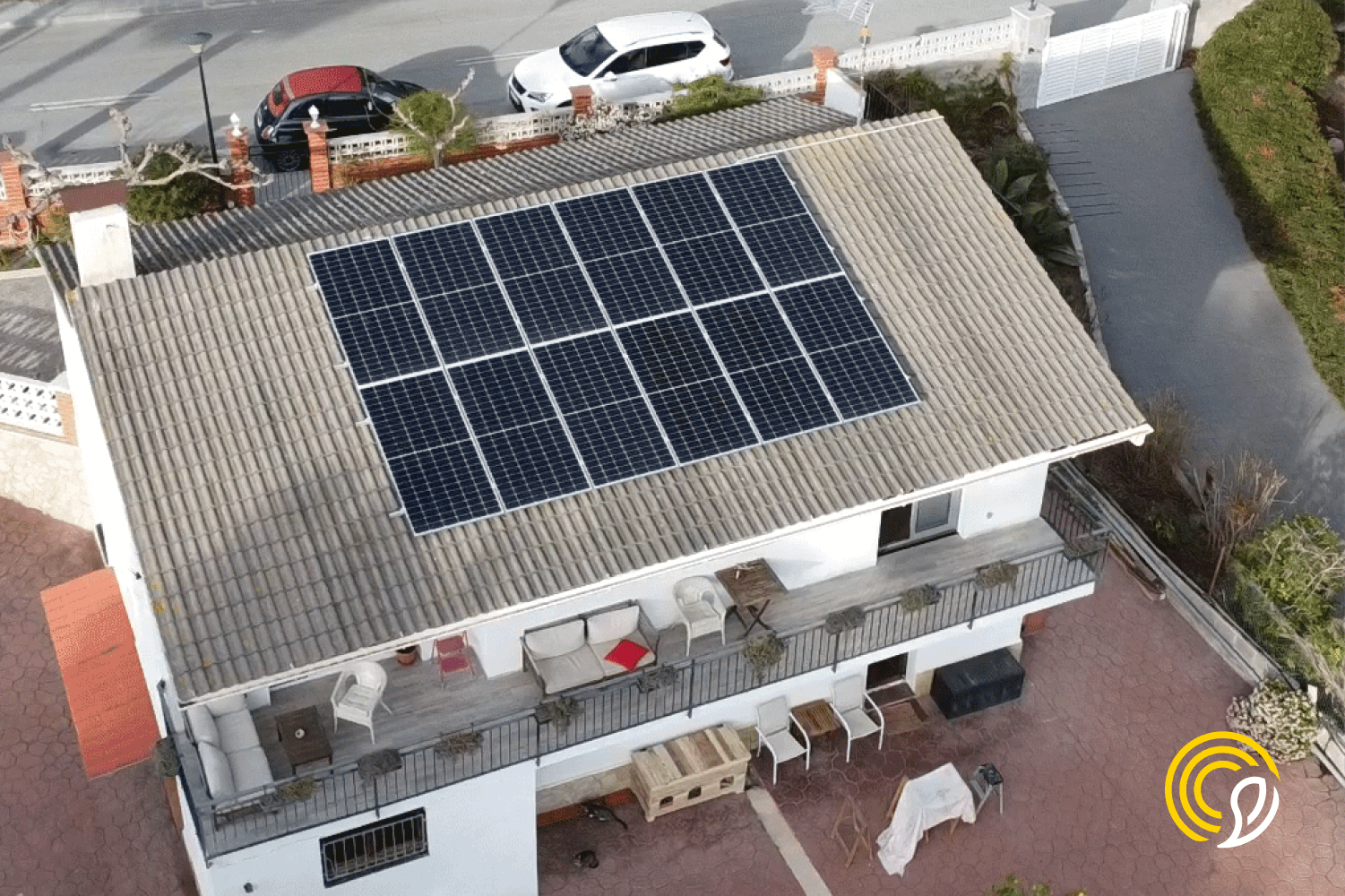

Installing solar panels with Sunhero

At Sunhero, we ensure that each client feels supported throughout the entire installation and post-installation process.

When you choose us as your solar energy provider, we offer personalized advice, including recommendations on insurance coverage. We want to make sure you are fully informed about all the available options and that you choose the solution that best suits your needs, so your investment in solar energy is fully secured.

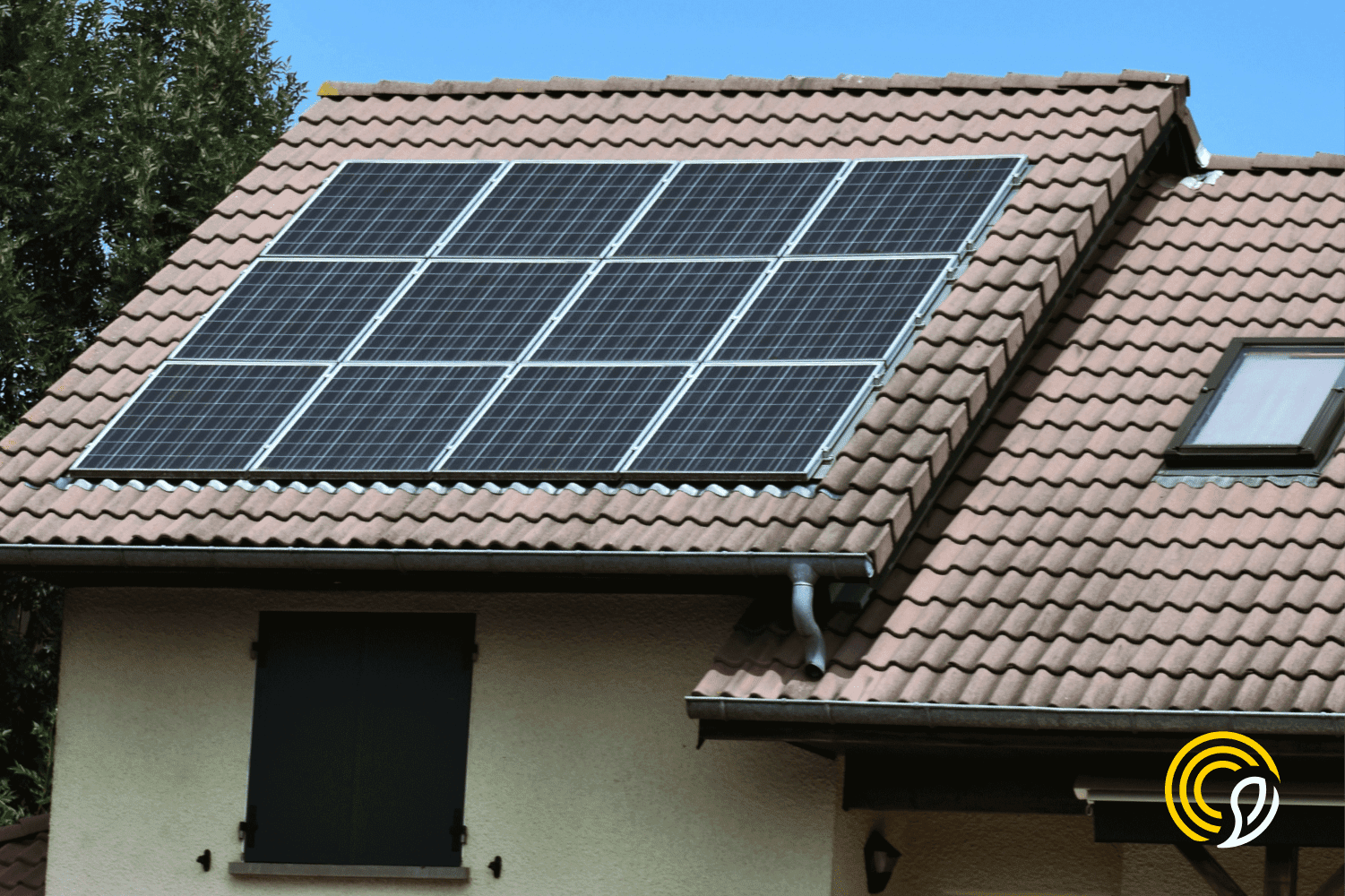

Maintenance of your solar system

In addition to insurance advice, at Sunhero we also offer a maintenance option for your photovoltaic system.

Although solar panels are extremely durable and require little maintenance, it is important to perform periodic inspections to ensure their efficiency over time.

We guide you on panel cleaning and inspections to verify that the entire system is working properly. If you want to learn more about solar panel maintenance, you can check out this blog article.

Having an adequate maintenance plan not only extends the life of your panels but also ensures that you continue to maximize your energy savings year after year.

Start today!

Fill out our free solar calculator and get a custom quotation