Deduct up to €9,000 from your solar panels on your income tax

Claudia Pardo, Content Specialist at Sunhero and a firm believer that solar energy can transform the world.

01/11/2024

3 min read

Table of Contents

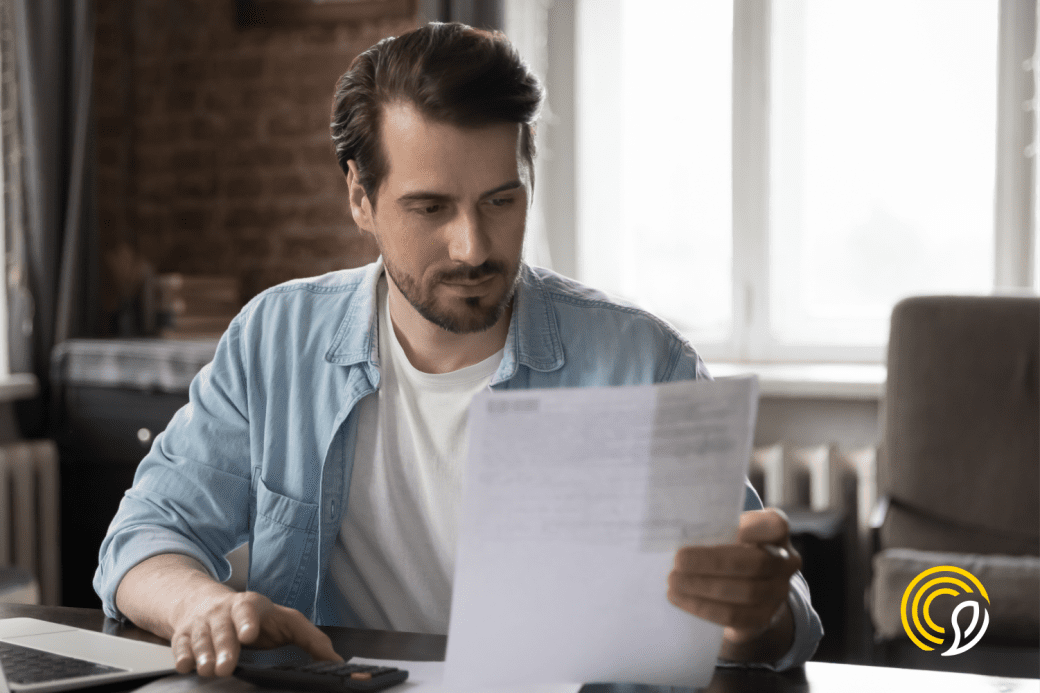

Deduct up to €9,000 on your income tax return! If you install your solar panels before the end of the year, you can deduct up to €9,000 in total: €3,000 on your 2024 tax return, €3,000 on your 2025 tax return and €3,000 on your 2026 tax return.

Install your solar panels now to benefit from the maximum of this tax deduction! Don’t miss this opportunity to save money by generating your own energy at home.

What is the IRPF deduction for solar panels?

This measure is part of the support provided through the EU-funded Next Generation programme.

One of the features of this deduction is that it does not take into account the location of the property, thus allowing more people to increase the energy efficiency of their homes and apply for this deduction.

What percentage can you deduct from your income tax?

The Tax Agency (AEAT) offers a system of deductions for solar panel installations that ranges from 20% to 60%, tailored for both private homes and homeowners’ associations or buildings. Below, we explain the requirements and specifications for each of the deductions.

20% deduction

This 20% deduction is exclusively intended to improve energy efficiency in heating and cooling for single-family homes, offering a maximum benefit of €1,000.

To qualify for this deduction, it is necessary to reduce energy demand for heating and cooling by at least 7%, a requirement that must be verified through an Energy Efficiency Certificate (EEC).

This incentive is available until 31 December 2024.

40% deduction

The second level of deduction allows for a reduction of up to €3,000 and is available for any type of home.

It can be validated in two ways:

- Achieving a high energy rating for the home, specifically an A or B rating on the Energy Efficiency Certificate (EEC). If the installation of solar panels improves the home’s efficiency to these levels, you can qualify for this benefit.

- A minimum 30% reduction in non-renewable primary energy consumption. As with the 20% deduction, this improvement must be verified through an Energy Efficiency Certificate (EEC).

This incentive is available until 31 December 2024.

60% deduction

This is the highest level of deduction available, allowing you to recover up to €9,000 over three years. It is designed for larger-scale projects, and the only difference from the 40% deduction is that it applies exclusively to buildings. The work must be carried out on either the entire building (single-family home) or an entire block (multi-family building).

To qualify for this deduction, one of the following requirements must be met:

- Achieving an A or B energy rating.

- Reducing non-renewable primary energy consumption by at least 30%.

As with the previous deductions, this improvement must be certified through Energy Efficiency Certificates (EEC).

This deduction has a maximum of €3,000 per year, allowing you to deduct any amounts exceeding this limit over the next four tax years, with a total maximum of €9,000.

This incentive is available until 31 December 2025.

Requirements to apply for the deduction

To benefit from this deduction in your income tax (IRPF), it is essential to obtain an Energy Efficiency Certificate both before and after the installation. This document will be the only way to demonstrate that the solar panel installation has contributed to the reduction in your home’s energy consumption, as required to qualify for these deductions.

Energy Efficiency Certificates issued up to two years before the start of the installation work will be valid as the pre-installation certificate.

To obtain this certificate, you must hire a qualified technician, who will issue the document after evaluating the energy performance of your home.

Additionally, it is important to note that the date on the post-installation energy certificate will determine the fiscal year in which you can apply for the deduction. For example, if you install the panels in 2024 but do not obtain the post-installation energy certificate until 2025, you will be able to claim the deduction in your 2025 tax return.

Moreover, to benefit from this deduction, you must be required to file a tax return.

If you are considering making the switch to solar energy, at Sunhero we take care of the whole process, from start to finish.

In addition to managing all the necessary permits for the installation process, we also offer the service of processing the Energy Efficiency Certificate (EEC), essential to apply for the IRPF deduction.

Start today!

Fill out our free solar calculator and get a custom quotation