Tax on Solar Panels: Understanding the Sun Tax in Spain

Claudia Pardo, Content Specialist at Sunhero and a firm believer that solar energy can transform the world.

12/12/2024

3 min read

Table of Contents

In this year 2024, the regulations both in Spain and in the EU regulatory framework remain firm in their stance: no taxes are required for the installation or generation of photovoltaic energy.

This policy reflects a continued commitment to the promotion of renewable energy sources, in line with the objectives of sustainability and energy transition. Furthermore, this scenario ensures that, despite possible changes in policy direction, the imposition of taxes on solar energy will remain out of scope, thus respecting the guidelines set by the European Union to protect and promote the use of clean and renewable energies.

This clear definition of regulations provides certainty for individuals and companies looking to go solar, encouraging the development of a greener and more sustainable energy future.

When considering installing solar panels in Spain, it is common to wonder whether there is a tax on solar panels or their use. To understand the current scenario, it is essential to look back at the history of solar energy legislation in the country and the infamous “Sun Tax.”

What was the Sun Tax in Spain?

The “Sun Tax” (“Impuesto al Sol”) was introduced in 2015 as a regulatory measure that required owners of photovoltaic (PV) installations to pay a fee for the energy they generated for self-consumption. This tax applied even when the solar energy was not fed into the grid, making Spain one of the few countries to penalise self-consumption of renewable energy.

Exceptions were granted to small installations (under 10 kW) in residential settings and isolated systems that were not connected to the grid. However, for many businesses and larger households, this tax significantly reduced the economic appeal of solar panels, slowing down the country’s progress toward the energy transition.

Repeal of the Sun Tax

In 2018, the Spanish government repealed the Sun Tax in response to public backlash, international criticism, and a growing demand for sustainable energy solutions. This repeal aligned with new European Union legislation, which recognised the rights of individuals and communities to generate, consume, and share renewable energy without punitive measures.

What does the current legislation say about taxes on solar panels?

Today, there is no Sun Tax or similar charge for generating solar energy in Spain. The legal framework is now highly supportive of renewable energy, with key measures including:

- Compensation for Surplus Energy: Homeowners with solar installations can benefit from net metering schemes, receiving credits or monetary compensation for surplus energy fed back into the grid.

- Regional Tax Incentives: Many autonomous communities in Spain offer tax deductions or subsidies for the installation of solar panels. These incentives vary by region but can cover a significant portion of the upfront costs.

- Exemption from Grid Usage Fees: Self-consumers are no longer subject to fees for energy they produce and consume on-site.

Impact of the Repeal on Solar Energy Adoption

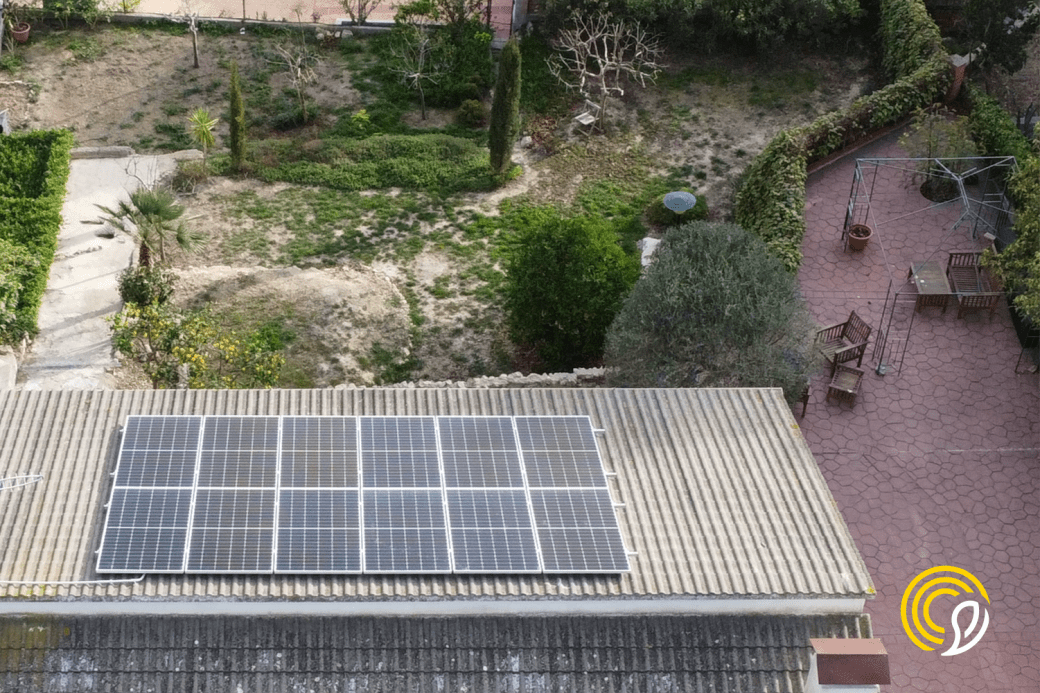

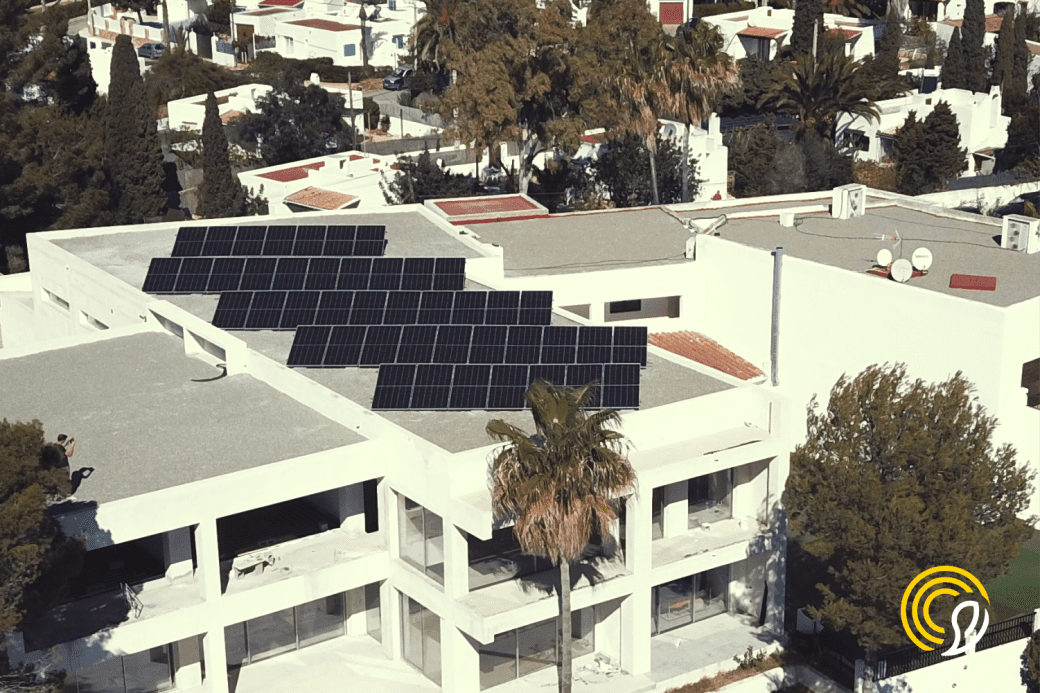

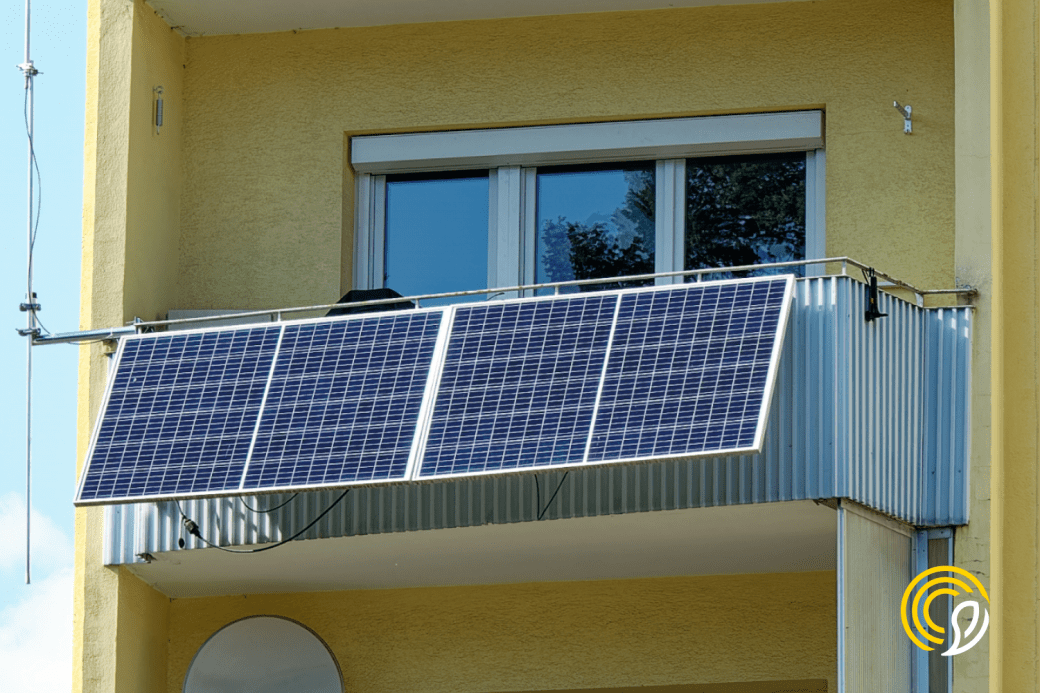

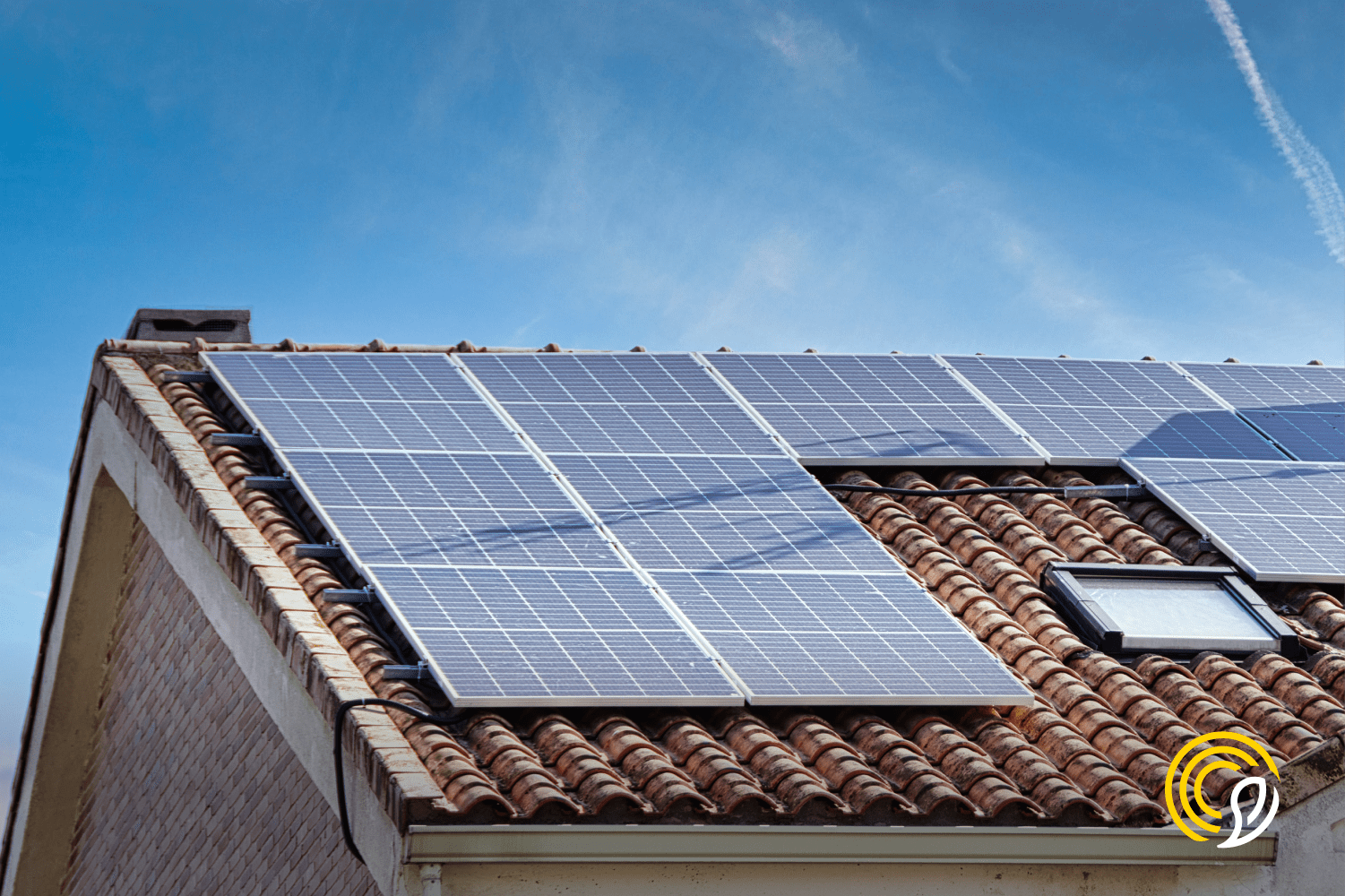

The repeal of the Sun Tax marked a turning point for solar energy in Spain. Since 2018, the country has witnessed a significant increase in the installation of photovoltaic systems, both residential and commercial. The updated legislation has removed barriers to entry, making solar energy more accessible and economically viable.

Spain’s climate, characterised by abundant sunshine, further enhances the attractiveness of solar panels, allowing households to achieve substantial savings on their electricity bills while reducing their carbon footprint.

Conclusion: No More Sun Tax in Spain

The Sun Tax in Spain is a thing of the past, and current policies actively promote the adoption of solar energy. There is no tax on the installation or use of solar panels, and homeowners can take advantage of financial incentives and surplus compensation schemes. With these supportive measures in place, Spain continues to position itself as a leader in renewable energy adoption.

If you’re considering installing solar panels, now is the perfect time to harness the sun’s power without worrying about unnecessary taxes. At Sunhero, we provide personalised advisory services to help you make the most of your solar investment. Get in touch today to start your journey towards sustainable energy.

Rebates and deductions for solar panels in Spain

In addition to the tax incentives applicable to ICIO and municipal contributions, the installation of solar systems can lead to reductions in other taxes. One example is the Property Tax (IBI), where reductions of up to 50% can be achieved in certain localities for several years.

At the national level, there is also the opportunity for a deduction in the IRPF, which can reach up to 60% for homeowners‘ associations that opt for solar energy.

Find everything about subsidies here or use our solar calculator to understand how much you could be saving.

Start today!

Fill out our free solar calculator and get a custom quotation